Things about Hsmb Advisory Llc

Impairment insurance can be pricey. And for those that select long-lasting care insurance policy, this plan may make impairment insurance unneeded. Check out more concerning lasting treatment insurance and whether it's right for you in the following section. Long-term care insurance coverage can aid pay for costs connected with lasting care as we age.

Hsmb Advisory Llc Fundamentals Explained

If you have a chronic wellness concern, this sort of insurance policy could wind up being vital (Health Insurance). Nonetheless, do not let it emphasize you or your bank account early in lifeit's normally best to secure a plan in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later on.

If you're a small-business owner, think about safeguarding your income by purchasing business insurance policy. In the occasion of a disaster-related closure or duration of rebuilding, organization insurance policy can cover your earnings loss. Consider if a significant climate occasion impacted your storefront or manufacturing facilityhow would that impact your revenue?

Plus, using insurance policy might sometimes set you back greater than it conserves in the future. For instance, if you obtain a contribute your windscreen, you might think about covering the repair expense with your emergency situation cost savings rather than your car insurance policy. Why? Due to the fact that using your vehicle insurance can cause your month-to-month premium to go up.

Top Guidelines Of Hsmb Advisory Llc

Share these pointers to secure loved ones from being both underinsured and overinsuredand talk to a relied on specialist when needed. (https://www.viki.com/collections/3896580l)

Insurance that is purchased by an individual for single-person insurance coverage or protection of a family members. The private pays the premium, as opposed to employer-based health insurance policy where the employer usually pays a share of the costs. Individuals may look for and purchase insurance policy from any strategies available useful link in the individual's geographical region.

People and families may get financial help to lower the expense of insurance costs and out-of-pocket costs, however just when registering via Connect for Health And Wellness Colorado. If you experience particular changes in your life,, you are eligible for a 60-day time period where you can sign up in an individual strategy, also if it is outside of the annual open enrollment duration of Nov.

The Ultimate Guide To Hsmb Advisory Llc

- Attach for Wellness Colorado has a complete checklist of these Qualifying Life Occasions. Reliant youngsters who are under age 26 are eligible to be included as relative under a parent's insurance coverage.

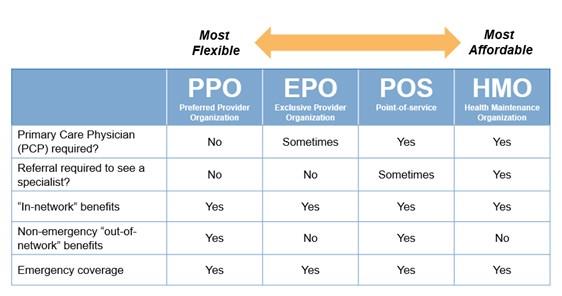

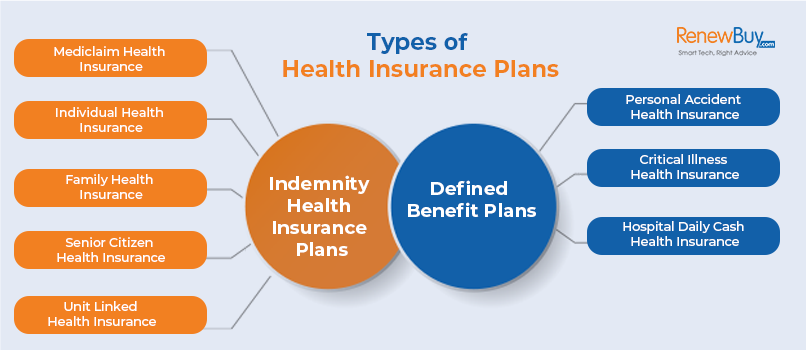

It may appear straightforward however recognizing insurance types can additionally be confusing. Much of this confusion originates from the insurance policy market's continuous goal to design customized coverage for policyholders. In designing flexible plans, there are a selection to pick fromand every one of those insurance policy types can make it difficult to comprehend what a particular policy is and does.

Everything about Hsmb Advisory Llc

If you pass away during this period, the person or individuals you have actually named as beneficiaries may get the cash money payout of the policy.

Many term life insurance policy policies let you convert them to a whole life insurance policy, so you do not shed coverage. Typically, term life insurance policy plan costs repayments (what you pay each month or year into your plan) are not secured in at the time of purchase, so every five or ten years you possess the policy, your premiums can increase.

They additionally have a tendency to be cheaper general than whole life, unless you buy a whole life insurance policy policy when you're young. There are also a few variations on term life insurance coverage. One, called team term life insurance policy, prevails amongst insurance policy alternatives you may have access to via your company.

The Ultimate Guide To Hsmb Advisory Llc

This is usually done at no charge to the employee, with the capacity to buy additional insurance coverage that's secured of the worker's paycheck. An additional variant that you might have access to via your company is supplementary life insurance coverage (Life Insurance). Supplemental life insurance can include unintentional fatality and dismemberment (AD&D) insurance, or burial insuranceadditional protection that might help your household in situation something unforeseen occurs to you.

Permanent life insurance policy simply refers to any type of life insurance coverage plan that does not run out. There are several kinds of permanent life insurancethe most typical types being entire life insurance policy and universal life insurance coverage. Whole life insurance policy is precisely what it seems like: life insurance policy for your entire life that pays to your beneficiaries when you pass away.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)